Home Insurance Adjuster Low Ball Offer

They may defend their low offer by claiming that you were partially at fault for the accident that caused your injuries or that the injuries you suffered werent severe enough to warrant a greater amount. If you believe a settlement offer is too low or know it will not cover all of your expenses do not agree to it.

7 Things Your Insurance Adjuster Doesn T Want You To Know

7 Things Your Insurance Adjuster Doesn T Want You To Know

If your contractor estimates the cost of repair to be significantly higher than the insurance companys adjuster you will know not to settle for the lowball offer.

Home insurance adjuster low ball offer. You do not have to accept an auto insurers settlement offer let alone the first one. This often results in homeowners disagreeing with the insurance adjuster and suspecting the home insurance adjusters estimate is too low. Instead dispute the offer and fight for what you need.

There have even been cases where the injured party has received little to no communication from the adjuster and then one day out of the blue a check arrives. Insurance companies want to reduce what they pay you. A home insurance adjusters job is to exam your property and estimate what the insurance company needs to pay out.

Insurance claims adjusters can be personable and easy to talk to but dont be taken in. Just make a counter demand that is a few points below your initial demand. Lowball offers are standard practice for insurance companies.

Dont Fall for Lowball Insurance Settlement Offers. Unfortunately disputes often arise between. Trust us they havent taken their eyes off the bottom line for one second.

A bio-hazard mitigation contractor once told me an adjuster insisted lowering his hourly rate from 225 to 85 because her estimating software didnt really have a comparable line item. The initial offer you receive from the insurance adjuster will almost always be a lowball offer. Insurance Settlements Are Negotiations.

During settlement discussions for injuries you suffered in an accident an insurance co. In fact the wait time for insurance adjusters not to be confused with public adjusters are up to 4 weeks. If the insurance company sends you a lowball offer it can feel like they are kicking you while youre down.

If an insurance adjuster sees a way to reduce the value of your claim and keep more funds in the companys coffers as such you can almost guarantee that they will act on it. If the insurance company offers a low-ball claim the restoration company in the meantime has been gathering evidence and has been itemizing the damages on their own. They Know Their Settlement Offer Is Too Low.

The primary reason that insurance adjusters lowball claim offers is based on the fact that insurance adjusters have the responsibility of saving the insurance company money. When you buy insurance to protect yourself against the economic loss of your valuables you expect your insurance company to treat you fairly by offering you a reasonable settlement for any claims you report. Insurance companies profit by paying out as little as possible on every claim they can and good-faith policy holders routinely receive low-ball estimates.

Gonzalez-Sirgo by dialing his direct number at 786 272-5841 calling the main office at 305 461-1095 or Toll Free at 1 866. How to Handle a Low Ball Initial Insurance Settlement Offer. This involves the creation of an estimate a formal overview of the damage.

Once the injured party reaches a breaking point the adjuster knows that it will be easier to sell them on a low-ball offer so they can just put the whole event behind them and move on. Option one no surprise is to simply accept the offer made by your insurance adjuster. Roof leaks flooded homes missing shingles and water damage caused calls to home insurance companies to surge.

Some insurance companies choose to save money by making lowball settlement offers to claimants including their own policyholders. And the insurance company already knows that. After Hurricane Irma in 2017 homeowners in Florida were devasted by property damage.

If the insurance company presents you with a homeowners insurance lowball estimate or an offer that you believe is too lowa common practice in the industry to avoid a lengthy negotiationyou canand often shouldreject the offer. Without an attorney to represent you what are your options. Dont be offended by a low-ball offer from an adjuster.

Armed with the facts they can negotiate with adjuster to get them to increase their offer. You can reach Miami Insurance Claims Lawyer JP. It is not uncommon to disagree with an insurance adjuster during the home insurance claims processIf you feel your home insurance settlement offer was too low you can dispute the amount.

They will typically come back to you with a second offer that is more to your liking. You do not have to accept the first offer and you often shouldnt. Filing an insurance claim can be frustrating on its own.

Theyre paid to put you at ease and if they can use charm to get you to take a lowball offer they will. Probably a lot less. When you receive a lowball settlement offer you really only have.

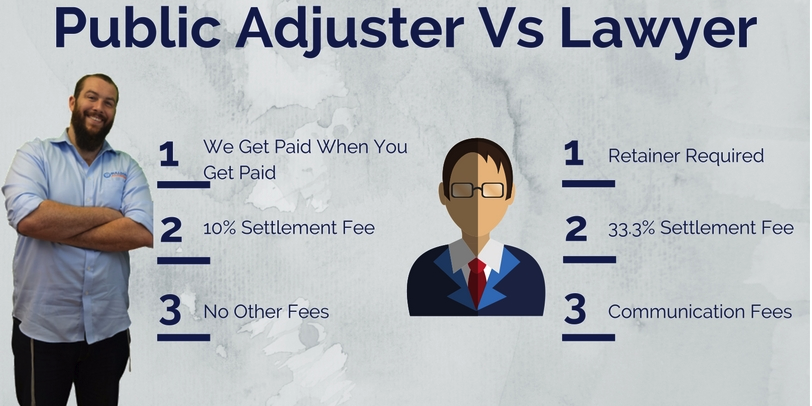

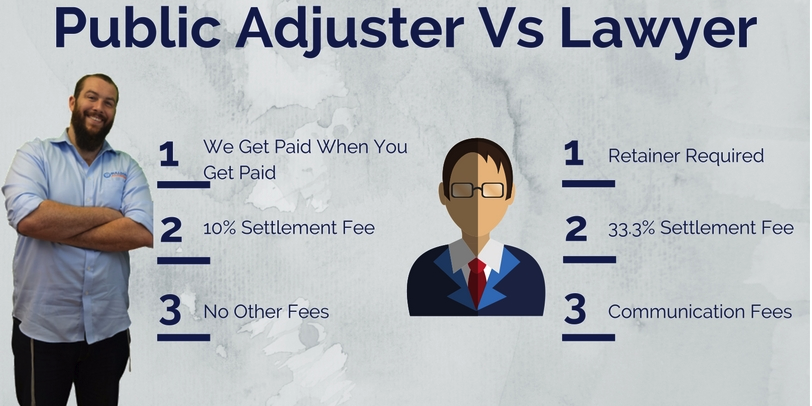

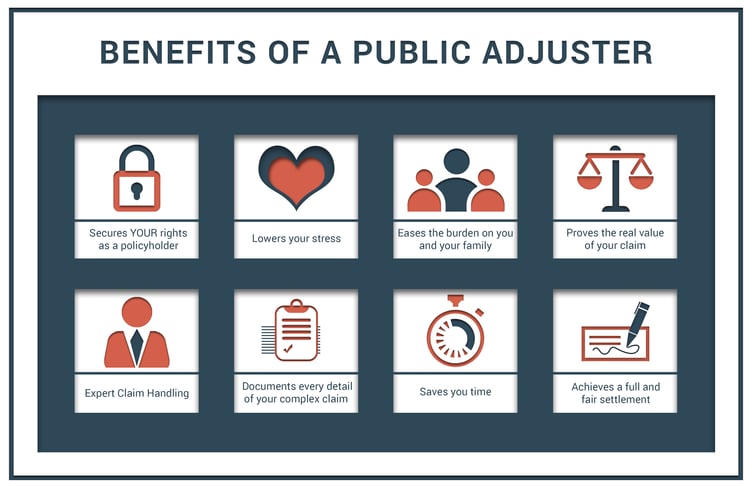

If you elect to dispute your homeowners insurance settlement you will need to be prepared to defend your reason to disagree with the insurance adjuster by gathering evidence of your damages your financial. If you need help dealing with an insurance adjuster or getting a fair assessment and settlement for your claim a licensed Public Adjuster can provide crucial expertise and assistance. May make a low-ball offer and claim any more is beyond their authority.

If youve received an early settlement offer from an insurance carrier its a safe bet that the offer represents less than youre really owed.

Insurance Adjusters Providing Medical Advice Personal Injury Lawyer Injury Attorney Medical Advice

Insurance Adjusters Providing Medical Advice Personal Injury Lawyer Injury Attorney Medical Advice

Some Have Heard Of A Public Adjuster When They Call Their Most Common Question Is Quot What Does A Public Adju Public This Or That Questions Business Pages

Some Have Heard Of A Public Adjuster When They Call Their Most Common Question Is Quot What Does A Public Adju Public This Or That Questions Business Pages

Writing An Auto Insurance Claim Letter With Sample Car Insurance Lettering Insurance Claim

Writing An Auto Insurance Claim Letter With Sample Car Insurance Lettering Insurance Claim

Fire Insurance Claims Tips And Help Public Adjusters Nc Sc Va Fire Damage Fire Insurance Claim

Fire Insurance Claims Tips And Help Public Adjusters Nc Sc Va Fire Damage Fire Insurance Claim

3 Biggest Insurance Company Tricks To Watch Out For After Property Damage Bulldog Adjusters

3 Biggest Insurance Company Tricks To Watch Out For After Property Damage Bulldog Adjusters

What Is A Public Adjuster When To Hire One And Why

What Is A Public Adjuster When To Hire One And Why

How To Counter Lowball Offers From Auto Insurers After Your Vehicle Is Totaled Car Insurance Facts Car Insurance Auto

How To Counter Lowball Offers From Auto Insurers After Your Vehicle Is Totaled Car Insurance Facts Car Insurance Auto

Atlantic Coast Public Adjusters Helped Me Out After Sandy Hit My House I Was Devastated To Make Things Worse Was That Insurance Best Insurance Atlantic

Atlantic Coast Public Adjusters Helped Me Out After Sandy Hit My House I Was Devastated To Make Things Worse Was That Insurance Best Insurance Atlantic

Pros And Cons Of Hiring A Public Adjuster The Claim Squad

How To Negotiate A Settlement With An Insurance Claims Adjuster

How To Negotiate A Settlement With An Insurance Claims Adjuster

Accident Settlement Negotiation Tips How To Deal With Insurance

Accident Settlement Negotiation Tips How To Deal With Insurance

What Is A Public Adjuster Why And When To Use A Public Insurance Adjuster Public Insurance

What Is A Public Adjuster Why And When To Use A Public Insurance Adjuster Public Insurance

How To Negotiate A Settlement With An Insurance Claims Adjuster Kapuza Lighty Pllc

How To Negotiate A Settlement With An Insurance Claims Adjuster Kapuza Lighty Pllc

What To Do If You Disagree With The Insurance Adjuster

What To Do If You Disagree With The Insurance Adjuster

When To Hire A Public Insurance Adjuster National Adjusters Are The Nations Top Rated Public Adjuster And Insurance Appraiser

You Re At A Disadvantage When You Have Major House Damage Or A Total Loss Of Your Home Seek A Public Adjuster S Help Public Change Is Coming Hurricane Season

You Re At A Disadvantage When You Have Major House Damage Or A Total Loss Of Your Home Seek A Public Adjuster S Help Public Change Is Coming Hurricane Season

Source:dwecceriue dwecctapaiue dwecgarspaiue dwecssrpaiue dwecvsrpaiue dwedeleienrie dwediocspaiue dwekigiasuea dwekvodisiur dwelovbisai

Comments

Post a Comment